The Many Benefits of LiveSurvey

LiveSurvey’s robust suite of features are designed to help credit unions develop a comprehensive member experience program. Here’s how these features benefit your overall strategy.

AI Insights

LiveSurvey leverages AI to detect trends, sentiments, and actionable insights from member feedback, empowering data-driven decision-making to enhance service quality.

AI-Driven Comment Curation & Multilingual Surveys

AI curates and categorizes member comments, surfacing key themes, while multilingual support ensures engagement with diverse member groups.

Microsoft Power BI Integration

Seamlessly integrate with Power BI for advanced visualizations and deeper analysis, enabling teams to track and share insights across the organization effortlessly.

No Arbitrary Limits or Per-user Fees

Unlimited Users with No Per-User Fees

Engage all employees in improving the member experience, fostering organization-wide accountability without worrying about additional costs.

No Arbitrary Limits

Enjoy unrestricted access to surveys, templates, questions, and reports, ensuring comprehensive coverage of every aspect of the member journey without constraints.

Tailored Reporting

Generate detailed reports such as branch performance, member satisfaction, and service efficiency, empowering data-driven decisions.

Scalable API & CRM Integrations

Seamlessly integrate with existing systems, allowing a unified view of member interactions for a consistent, personalized experience.

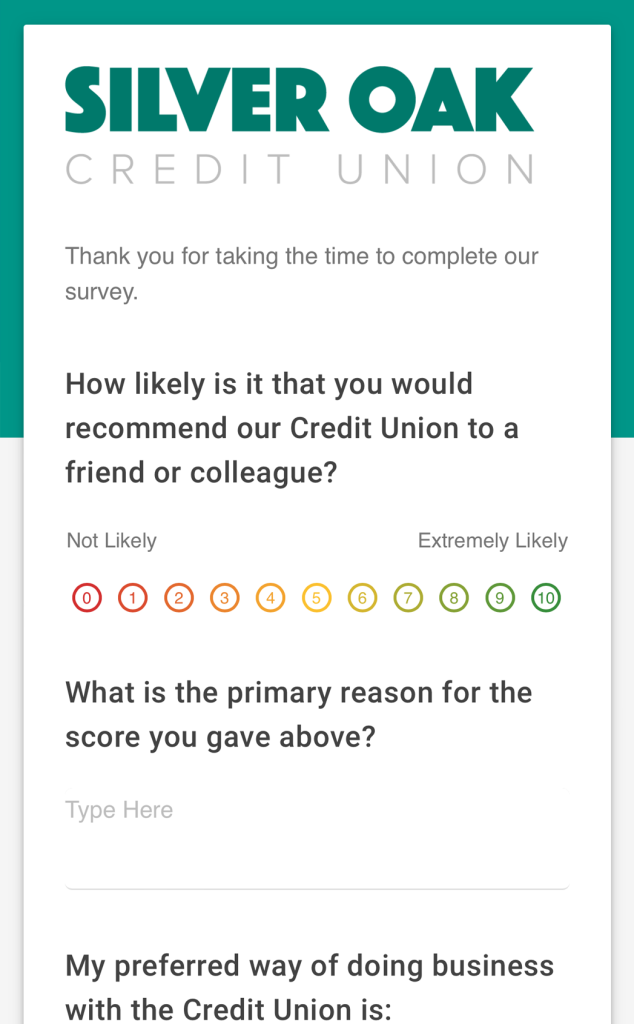

Customizable to Meet Branding and Feedback Requirements

Custom Branding & Exportable Data

Align surveys with your credit union’s brand identity, enhancing member trust and recognition. Easily export responses for in-depth analysis and reporting.

Transaction-Driven Surveys

Trigger surveys based on specific member transactions, capturing feedback at critical touchpoints to better understand satisfaction and experience.

Employee & Board Surveys

Collect internal feedback from staff and board members to promote continuous improvement and align leadership, employees, and member expectations.

Holistic Member Feedback

Gather insights across multiple interactions, such as deposits, loans, or account changes, providing a comprehensive view of the member journey.

Surveys For Immediate Feedback Across Key Metrics

Collect instant feedback across key metrics to capture member experiences as they happen, ensuring timely insights for proactive improvements.

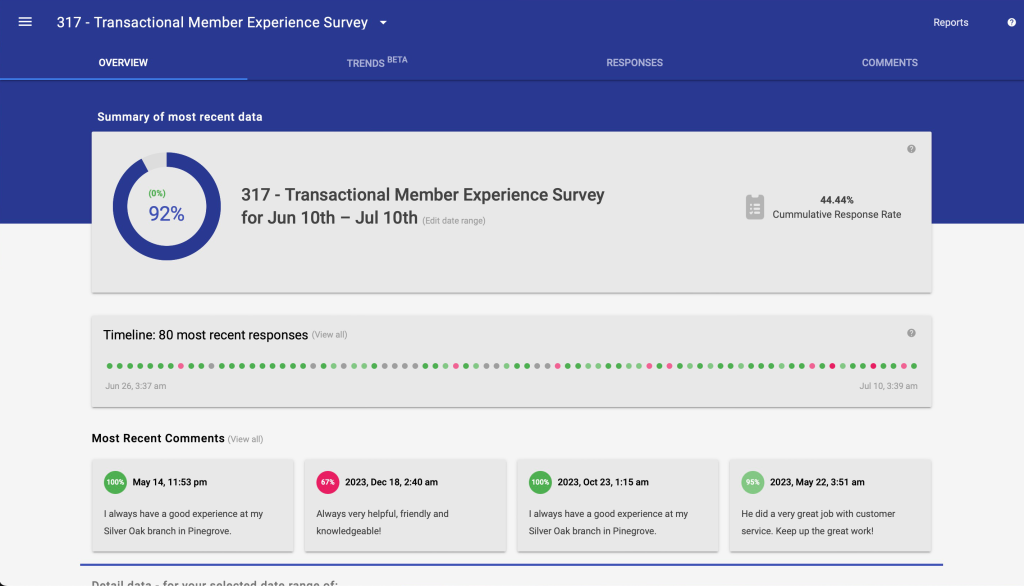

Real-Time Reports & Participation Tracking

Monitor survey results over time with visual histories and real-time participation tracking, helping you assess engagement and make timely strategy adjustments.

NPS & MES Metrics

Use Net Promoter Score (NPS) and Member Effort Score (MES) to quickly gauge member loyalty and the ease of their experience, highlighting areas that need improvement

Branch, Generation, and Staff Leaderboard Insights

Segment responses by branch and member demographics to uncover localized or generational trends. Motivate employees with staff leaderboards that recognize performance and inspire competition.

Credit Union Service — From a Credit Union!

Wholly Owned CUSO of Maps Credit Union

LiveSurvey, based in Salem, Oregon, is 100% credit union-owned, aligning directly with the values and mission of the industry to meet its unique needs.

Six-Month Guarantee & Discounted Pricing

A six-month satisfaction guarantee and special credit union pricing demonstrate LiveSurvey’s commitment to providing value to credit unions of all sizes.

Email and Chat Support

Reliable, support ensures smooth operations, enabling credit unions to promptly address issues and maintain uninterrupted member experience programs.

Seamless Member Experience

Continuous support helps credit unions stay focused on delivering excellent service and enhancing member satisfaction without delays.

Proactive Assistance

LiveSurvey’s support team works closely with credit unions to resolve issues and optimize platform performance, fostering a positive user experience.

Tailored for Credit Unions

As a dedicated CUSO, LiveSurvey is specifically designed to enhance the credit union member experience with tools, insights, and integrations aligned with industry goals.