It’s easy to think your net Promoter Score (NPS) is arbitrary. However, even as a vague, catch-all metric, it can tell you a lot.

LiveSurvey and Maps Credit Union looked deeper into what their NPS was telling them. What they learned was downright surprising.

Read on to learn more about the value of credit union NPS (and what it can tell you about your members).

The Strengths and Weaknesses of NPS

Historically, LiveSurvey cautions against overreliance on NPS. Credit unions can fall into a few traps while using it:

- Using only NPS and no other survey questions;

- Using NPS purely for peer benchmarking and nothing else;

- Introducing sampling bias; and

- Misinterpreting NPS results.

All told, NPS has many weaknesses. Not only is it easy to use it incorrectly, but it also typically doesn’t tell you very much. At the end of the day, the only thing NPS really does is tell you whether a given respondent is likely to recommend the credit union to someone else.

Of course, NPS would have died if people hadn’t found ways to learn more from it (and turned it into a true performance metric).

For example, Maps Credit Union was able to correlate a member’s given NPS score with their value to the credit union.

Quantifying the Value of Credit Union NPS

Maps Credit Union wanted to find out what their member experience was worth. Their results were surprising. And it all started with NPS.

Maps took completed responses to their NPS survey dating back 1–2 years prior. For each response, they measured the member’s actions:

- Loan products opened;

- Memberships closed; and

- Change in account balances.

Maps learned that there is a strong correlation between member experience (as measured through NPS) and member value to the credit union.

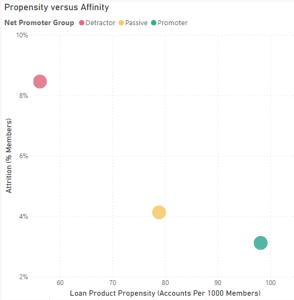

Here’s the equivalent of 1,000 words:

This graph shows a member’s propensity to take out a new loan vs their likelihood to attrite, grouped according to whether they were NPS promoters, passives, or detractors.

- Promoters were the most valuable members. They were the least likely to close their accounts and the most likely to get new loan products.

- Passives were also valuable members. However, they were slightly more likely to close their accounts and were a bit less likely to take out a new loan.

- Detractors were significantly more likely to leave the credit union. Not only were they nearly 3x more likely to attrite than Promoters, but they were just over half as likely to open a new loan.

It’s important to remember here that Maps Credit Union’s findings here are correlative, not causative. Simply improving a member’s experience won’t magically cause them to take out a new loan.

Still, Maps’ findings are significant proof that better member experience correlates to higher credit union growth and profitability!

Learn Your Credit Union NPS

Want to learn your credit union’s NPS? Or would you like help understanding it?

LiveSurvey is a real-time survey platform built specifically for credit unions, by credit unions. We’d be happy to help you deliver, interpret, and improve your NPS survey.

(We can also show you how to go beyond NPS!)