Ahh, the (new) classic question: Customer Effort Score vs Net Promoter Score. Or, if you like acronyms, CES vs NPS. What a conundrum! Where to even begin…

There are numerous ways to measure member experience in credit unions. The easiest way is, of course, with a survey. After all, if you want to know how someone feels, why not just ask them?

Asking is easier said than done, however. There is no silver bullet for measuring member experience. There is not one single member satisfaction metric that is necessarily better than another. And yet, member experience must still be measured. And, if it’s to be measured broadly, there are a lot of logistics to work through.

How many people should you survey? How many questions should you ask? What kind of survey do you want to conduct?

Well, considering we already have blogs covering those other topics, let’s talk about what kind of survey to conduct. There are two well-known survey types that businesses around the world rely on. One is called the Net Promoter Score, and the other—a relative newcomer to the game—is called the Customer Effort Score.

So, what’s the difference?

The Net Promoter Score

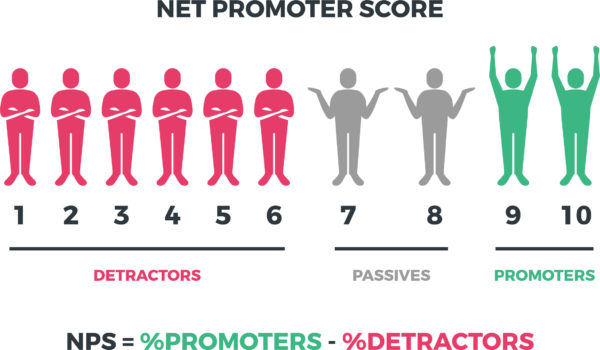

The Net Promoter Score, or NPS, is a simple way of measuring customer appreciation. It asks a simple question: “how likely are you to recommend us to a friend or colleague?” Respondents answer on a scale of 1–10, with 1 being “not at all likely,” and 10 being “very likely.”

The NPS survey operates on the principle that people’s experiences can be categorized into three groups: promoters, passives, and detractors.

- Promoters are those who respond with a 9 or a 10. These are the people who don’t just like your credit union—they’ll probably tell other people about their good experiences with it. Promoters are more likely to positively influence other people’s opinions about your brand.

- Passives are those who respond with a 7 or 8. They tend to appreciate your credit union, but there may be a few issues that they’re not so thrilled about. Passives are less likely to voluntarily share their good experiences with others, so they won’t impact your public perception much.

- Detractors are people who respond with a 1–6. These respondents probably aren’t very happy with your credit union (or something or someone in it). Detractors are more likely to warn others about problems and issues, which means they may hurt your public image.

After all the scores are tallied and numbers are crunched, the resulting scores range from -100 to 100. The average NPS for an American business is right around 5, but it varies per industry.

The Advantages and Disadvantages of Net Promoter Scores

As with most things in life, NPS surveys aren’t perfect. There are some good things and there are some not-so-good things. Here’s how they break down.

1. NPS Pros

The following is a non-exhaustive list of why you should consider using an NPS survey to track member experience.

- It’s very popular. NPS survey scores are used across the entire globe. That makes it easy to understand and even easier to benchmark.

- It’s very simple. You can obtain a broad understanding of member sentiment with only one question.

- Recommendations beat satisfaction. Other surveys may not be able to tell you much about your reputation.

- You will know who your champions and proponents are. You can also identify which members need more attention.

- It indirectly looks at price and competition to measure satisfaction, giving you a better picture of your value.

2. NPS Cons

Of course, a survey designed to be so simple that it can work with only one question will have some drawbacks. Here is the non-exhaustive list of why you shouldn’t rely solely on NPS surveys to track member experience.

- NPS scores are broad, so you can’t always pinpoint what exactly is contributing to your score.

- It’s easy to get caught up in the overall score. Consequently, too few people follow up to drill deeper into why the score was given.

- It’s so popular that many organizations benchmark themselves against other industries as well. However, that can give misleading information.

- The metric is poorly defined, so member responses don’t necessarily align with their behavior.

- To be statistically valid, you need a lot of responses. Otherwise, a few responses can have undue impacts on the overall score.

Overall, the list of pros and cons is pretty straightforward. One could certainly see how a respondent might give a score of “6” thinking they’re rating the credit union better than average. However, the metrics rank that as a negative score.

With that in mind, it’s easy to see why your credit union shouldn’t put all its eggs in one NPS basket. So, should your credit union use the Customer Effort Score (CES) method?

The Customer Effort Score

The Customer Effort Score (CES) measures how much effort was required on the customer’s behalf to fulfill a given request, purchase, or interaction. It doesn’t measure the strength of the customer–business relationship like the NPS score, nor does it measure customer satisfaction. However, the CES is a critical predictor of customer loyalty and retention.

The idea behind the CES is that people are, well, lazy. Researchers at Harvard University found that a better predictor of customer loyalty was convenience, not satisfaction. They saw that more than any other factor, customers prefer goods and services that require minimal effort on their part.

If you don’t believe that people generally value convenience over quality, just look at the fast food industry. No, you won’t get a better burger from McDonald’s than you will from your local gastropub, but it’ll be much cheaper and much faster. That’s why McDonald’s has served billions and the gastropub can’t afford a TV ad.

CES questions usually use a scale to measure the ease of interacting or purchasing. The scales range in size, but they are often 5- or 7-point scales like Likert scales.

They ask things like, “How easy did we make it to open a checking account?” or “How easy was it to apply for a credit card?”

Responses will tell you if there’s too much friction in the interaction or transaction. Your credit union could offer the best mortgage rates around, but if your members have to jump through hoops to get one? Good luck.

The Advantages and Disadvantages of Customer Effort Scores

Just like with the NPS, the CES isn’t perfect. It’s designed to measure one basic thing, so as you can imagine, it’s not set up to cover a wide array of needs. Here are the pros and cons of the CES.

1. CES Pros

The following is a non-exhaustive list of why you should consider using the CES to track customer experience.

- It’s great for measuring specific transactions and interactions. Credit unions can get a granular view of where they make things easy for their members (and where they could reduce some friction).

- It focuses on the member experience. It doesn’t get bogged down in organizational goals—it zeroes in on a factor that the member values highly (convenience).

- It gives a very clear indication of what you can do to improve specific experiences.

2. CES Cons

It’s not all sunshine and roses for CES surveys. Just like with the NPS survey, CES surveys are pretty narrow. Accordingly, they come with a few drawbacks.

- The CES metric doesn’t have the same popularity. With NPS scores, credit unions can easily perform peer benchmarking. The lack of adoption for CES scores limits a credit union’s ability to do the same.

- CES surveys don’t measure broadly. That is, they measure only specific experiences. Moreover, they measure only the perceived effort those experiences required.

- Doesn’t directly measure loyalty or retention. While that’s the end goal, CES surveys are ultimately about improving efficiency rather than quality.

Although the Customer Effort Score is intended to help businesses achieve higher customer loyalty, they’re more of a starting point to that goal. Ease and convenience alone don’t make a desirable product. The CES measurement is valuable, but it shouldn’t be your sole consideration when tracking customer experience.

NPS vs CES: Final Thoughts

When it comes to surveys, you can’t exactly go wrong with either the NPS or the CES. Both models provide your organization with incredible, high-value member experience feedback. Both can (and should) be integral parts of your strategic planning process.

However, it’s important to remember that NPS and CES surveys measure rather narrowly. They’re designed to help you understand what people might say about you, or how easy you make things for your customers.

While those are important, they don’t measure everything. They especially don’t measure everything that a credit union would need to measure. So, while we highly recommend using both NPS and CES surveys at your credit union, we also recommend using other survey questions and metrics as well.

If you’d like to read more about credit union surveys and survey strategies, subscribe to our blog! Or, if you’d prefer to let fate (okay, it’s us—we’re fate) take the wheel, follow the links below!